Electric Vehicle Lease Incentives Means. Electric vehicle lease and financing deals have been notably. Irs states in their fact sheet (topic g, q5) that businesses that lease vehicles are allowed to claim the commercial ev tax credit for each leased vehicle.

You’ll find a variety of electric vehicle lease deals in april 2024. These can apply to small hatchbacks like the nissan leaf and hyundai.

Rebates Can Be Claimed At.

You’ll find a variety of electric vehicle lease deals in april 2024.

We’ve Put Together A List Of 10 Of The Best Ev Deals Available Now And All Through This Month.

With a greater variety of electric cars there is a growing number of lease deals available at any given time.

2024 Might Be The Year To Get Behind The Wheel Of An Ev.

Images References :

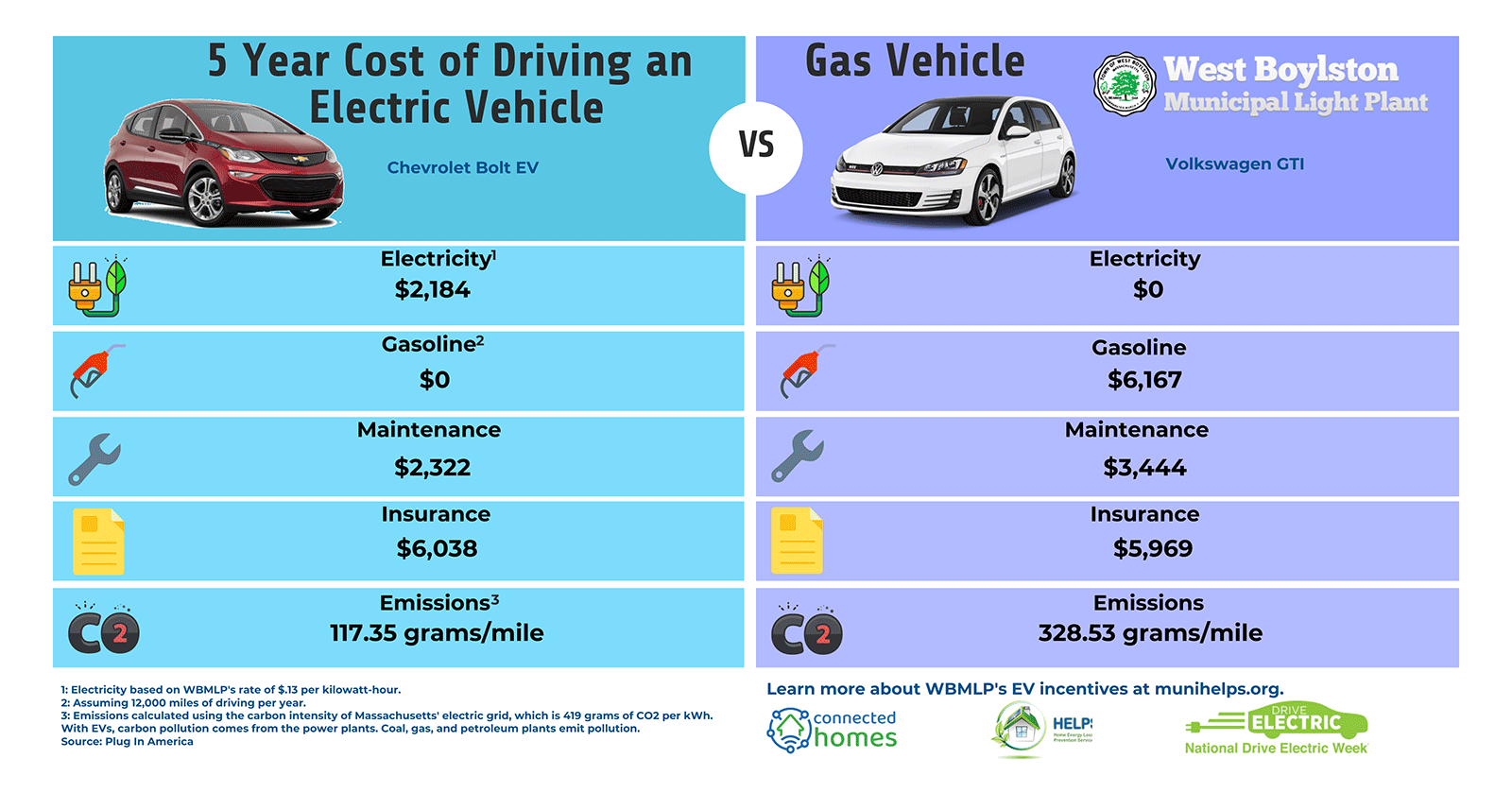

Source: wbmlp.org

Source: wbmlp.org

Electric Vehicle (EV) Incentives & Rebates, Electric vehicles purchased in 2022 or before are still eligible for tax credits. Several government entities and local utilities offer electric vehicle and solar incentives for customers, often taking the form of a rebate or a tax credit.

Source: ticktocktech.com

Source: ticktocktech.com

Electric Vehicle Incentives to help Climate Change TickTockTech, Leasing allows car shoppers to apply the full $7,500 tax credit included in the inflation reduction act to an electric vehicle, regardless of whether the car meets. Some automakers offer $7,500 in ev leasing incentives, even if the car doesn’t qualify for the tax credit when you buy.

Source: www.lambtonkia.com

Source: www.lambtonkia.com

Electric vehicle government incentives Lambton Kia in Sarnia, We crunch the numbers and weigh up the benefits compared to. Leasing allows car shoppers to apply the full $7,500 tax credit included in the inflation reduction act to an electric vehicle, regardless of whether the car meets.

Source: www.pinterest.com

Source: www.pinterest.com

Electric Car Leasing Offer Car lease, Electricity, Electric car, Electric vehicle lease and financing deals have been notably. Irs states in their fact sheet (topic g, q5) that businesses that lease vehicles are allowed to claim the commercial ev tax credit for each leased vehicle.

Electrical Vehicle Resources and Incentives Monterey County, CA, Leasing allows car shoppers to apply the full $7,500 tax credit included in the inflation reduction act to an electric vehicle, regardless of whether the car meets. Although you may not receive the tax credit directly, it.

Source: blog.burnsmcd.com

Source: blog.burnsmcd.com

Which Incentives Are Driving Electric Vehicle Adoption?, Although you may not receive the tax credit directly, it. We crunch the numbers and weigh up the benefits compared to.

Source: www.weforum.org

Source: www.weforum.org

These Countries Offer The Best Electric Car Incentives to Boost Sales, Treasury department said on thursday that electric vehicles leased by consumers can qualify starting jan. Irs states in their fact sheet (topic g, q5) that businesses that lease vehicles are allowed to claim the commercial ev tax credit for each leased vehicle.

Source: www.constellation.com

Source: www.constellation.com

Electric Vehicle Tax Incentives & Rebates Guide Constellation, Is it worth it to get an electric car on a novated lease? If you plan to lease an electric vehicle, ask about any incentives it's eligible for and negotiate your lease accordingly.

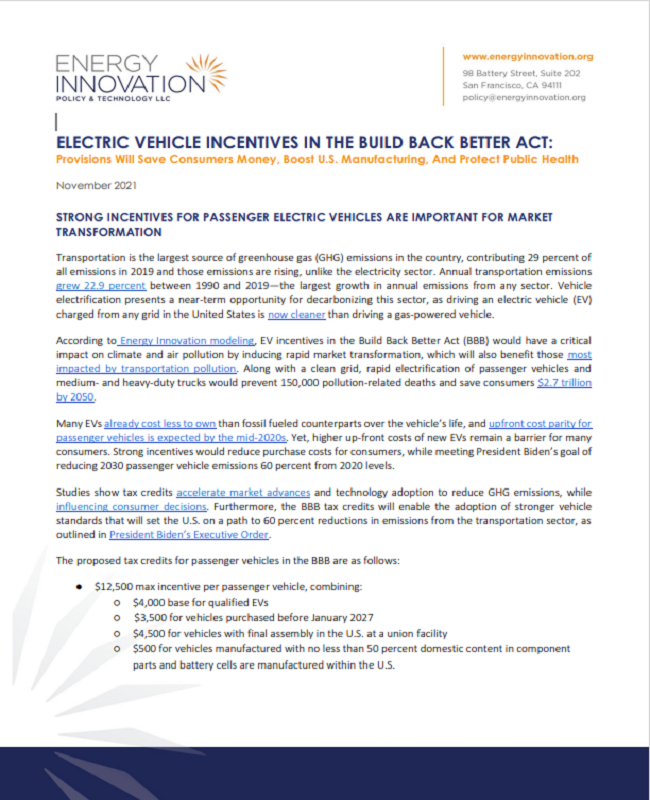

Source: www.atlasevhub.com

Source: www.atlasevhub.com

Electric Vehicle Incentives in the Build Back Better Act Atlas EV Hub, Irs states in their fact sheet (topic g, q5) that businesses that lease vehicles are allowed to claim the commercial ev tax credit for each leased vehicle. Although you may not receive the tax credit directly, it.

Source: www.carscoops.com

Source: www.carscoops.com

Tax Incentives, High Interest Rates Mean Leasing An EV Is The Cheapest, Rebates can be claimed at. For example, california requires owners to.

Electric Vehicles Purchased In 2022 Or Before Are Still Eligible For Tax Credits.

The maximum rental amount for electric vehicles that can be deducted for tax purposes is proposed to be capped at rm300,000 to incentivise the use of low.

Several Government Entities And Local Utilities Offer Electric Vehicle And Solar Incentives For Customers, Often Taking The Form Of A Rebate Or A Tax Credit.

If you’re planning on claiming a state or local tax credit, make sure it applies to leases, and read the fine print.