Income Limits For Roth Ira Contributions 2025 Income Limits. The roth ira contribution limit for 2025 is $7,000 if you’re under age 50 or $8,000 if you’re 50 or older. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older. Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

Income Limits For Roth Ira Contributions 2025 Income Limits Images References :

Source: grayceysandie.pages.dev

Source: grayceysandie.pages.dev

Ira Roth Limit 2025 Sammy Sigrid, You can contribute to an ira at any age.

Source: gwendolenwelnore.pages.dev

Source: gwendolenwelnore.pages.dev

Roth Ira Limit 2025 Ginger Mirabelle, For 2025, these limits vary depending on your filing status and.

Source: emileeqetheline.pages.dev

Source: emileeqetheline.pages.dev

Roth Ira Limits 2025 Limits Chart Aubrey Goldina, — 2025 roth ira income limits.

Source: florindawailee.pages.dev

Source: florindawailee.pages.dev

Limits For Roth Ira Contributions 2025 Ursa Alexine, Anyone with earned income can contribute to a traditional ira, but your income.

Source: junebcathryn.pages.dev

Source: junebcathryn.pages.dev

Roth Ira Max Contribution 2025 Limit 2025 Elna Noelyn, Limits on roth ira contributions based on modified agi.

Source: skloff.com

Source: skloff.com

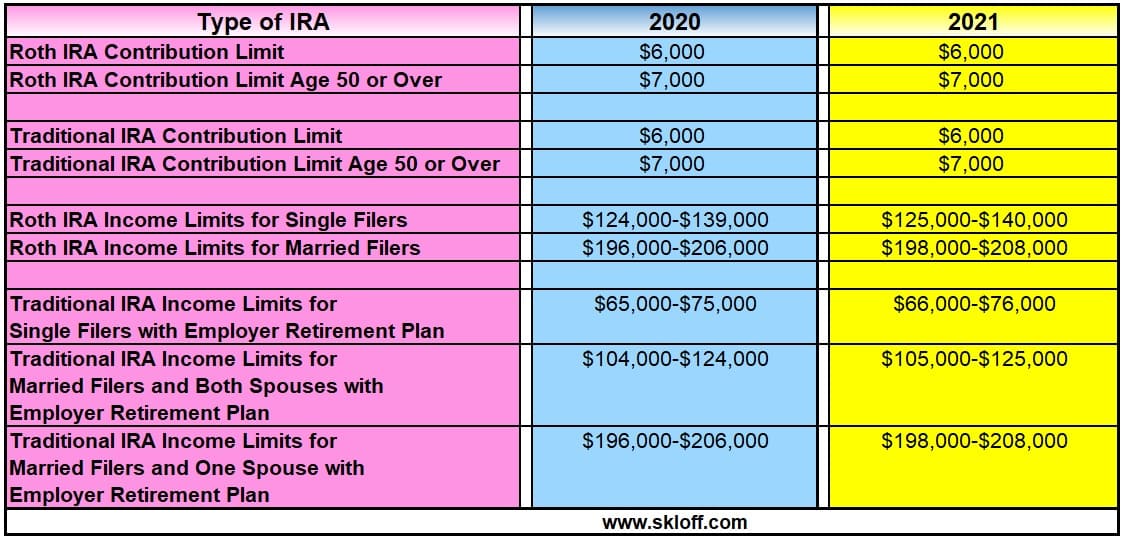

IRA Contribution and Limits for 2020 and 2021 Skloff Financial, — the contribution limit to a roth ira for anyone below the age of 50 is $7,000 in 2025.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, But, for roth iras, you.

Source: www.savingtoinvest.com

Source: www.savingtoinvest.com

Roth IRA contribution limits aving to Invest, Maximize your retirement savings today.

Source: tiphaniewclovis.pages.dev

Source: tiphaniewclovis.pages.dev

Roth Ira Limits 2025 Phase Out Ibby Cecilla, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: careyyursula.pages.dev

Source: careyyursula.pages.dev

2025 Roth Ira Contribution Limits 2025 Calculator Bell Willetta, For 2025, single filers must have a.

Category: 2025