Trucker Per Diem 2024. The per diem rate for meals in 2022 was 100% of $69 per day. You can access all other foreign per diem rates at aoprals.state.gov/web920/per_diem.asp.

Per diem does not apply for lodging. Companies deduct the 65 or whatever, and then give drivers cpm per diem.

Our Company Mission Is To Help Trucking Families And That Includes The Company.

See section 4.05 of rev.

Have A Question About Per Diem And Your Taxes?

The per diem rate for meals on 2023 was 80% of $69 per day.

Truck Drivers Are Required To Claim Actual Lodging Expenses.

Images References :

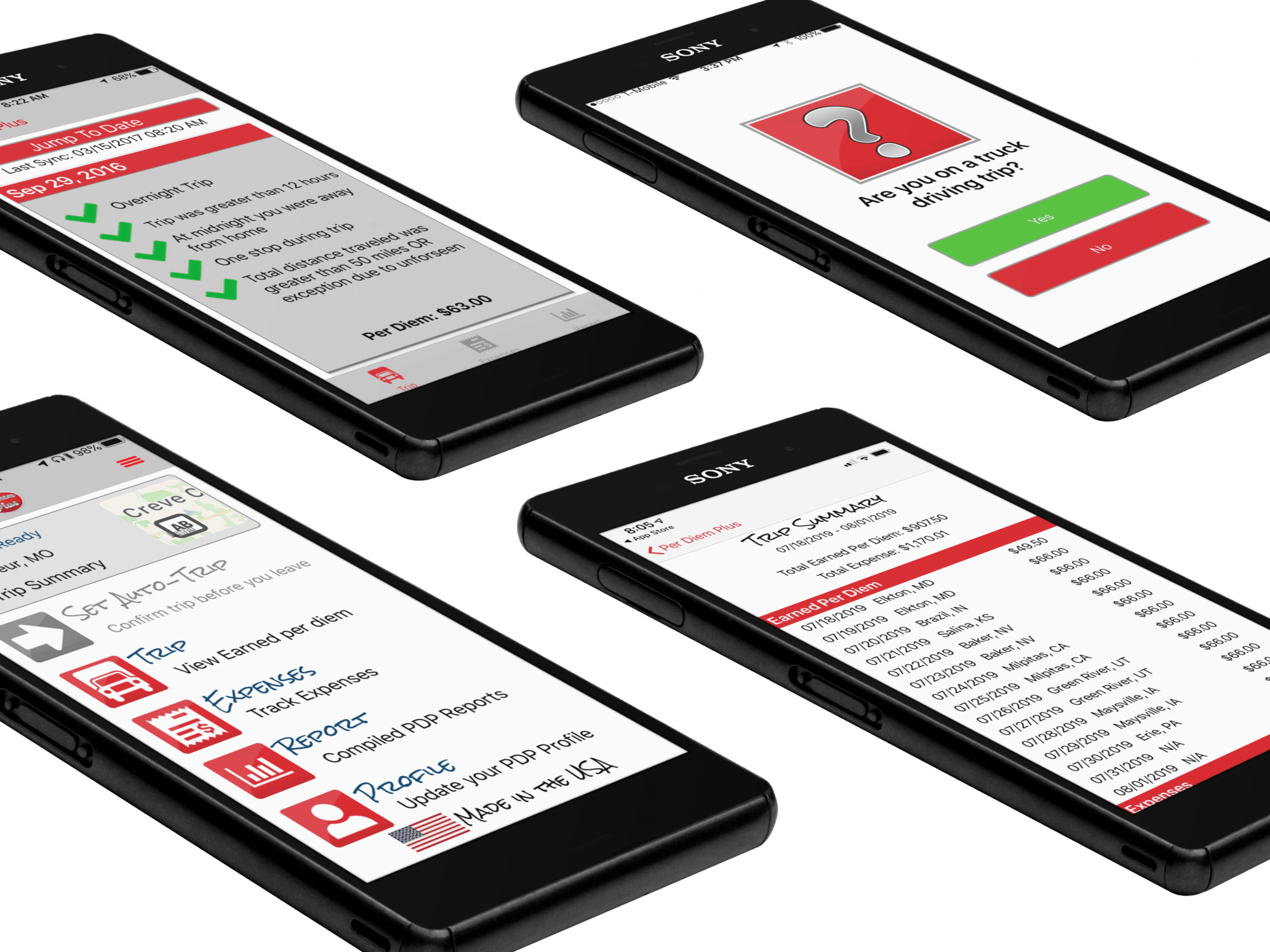

Source: www.perdiemplus.com

Source: www.perdiemplus.com

2022 Special Trucker Per Diem Rates Per Diem Plus, He also previously served as the consulting per diem tax expert for omnitracs. Discover tips for new truck drivers and delve into insights on how to become a better truck driver, ensuring safety and efficiency on the road.

Source: www.marksullivanconsulting.com

Source: www.marksullivanconsulting.com

2023 Trucker Per Diem Rates, Before founding superior trucking payroll service, mike was the cfo of a trucking. Learn more by listening to our recent podcast about the per diem program below!

Source: www.youtube.com

Source: www.youtube.com

Trucker 101 Per diem tax basics YouTube, The per diem rate for meals in 2022 was 100% of $69 per day. He also previously served as the consulting per diem tax expert for omnitracs.

Source: fleetnewsdaily.com

Source: fleetnewsdaily.com

Per Diem Plus and Platform Science Announce New Collaboration Bringing, Learn more by listening to our recent podcast about the per diem program below! Truck drivers are required to claim actual lodging expenses.

Source: www.perdiemplus.com

Source: www.perdiemplus.com

2021 Special Trucker Per Diem Rates Per Diem Plus, Have a question about per diem and your taxes? Special rate for transportation workers.

Source: www.marksullivanconsulting.com

Source: www.marksullivanconsulting.com

Trucker Per Diem & 10 OwnershipRelated Party Rule, Our company mission is to help trucking families and that includes the company. In addition to his time working with per diem plus, mark works in private practice as an enrolled agent at mark sullivan consulting, pllc specializing in.

Source: www.perdiemplus.com

Source: www.perdiemplus.com

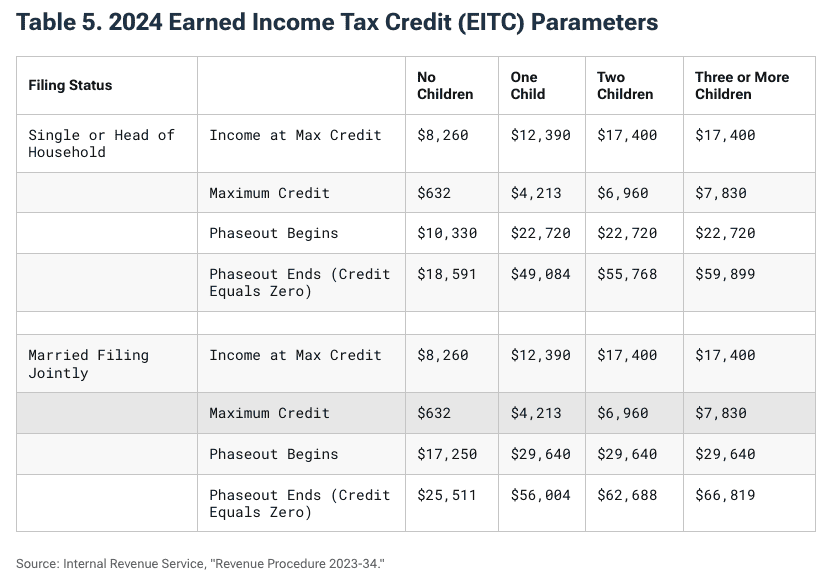

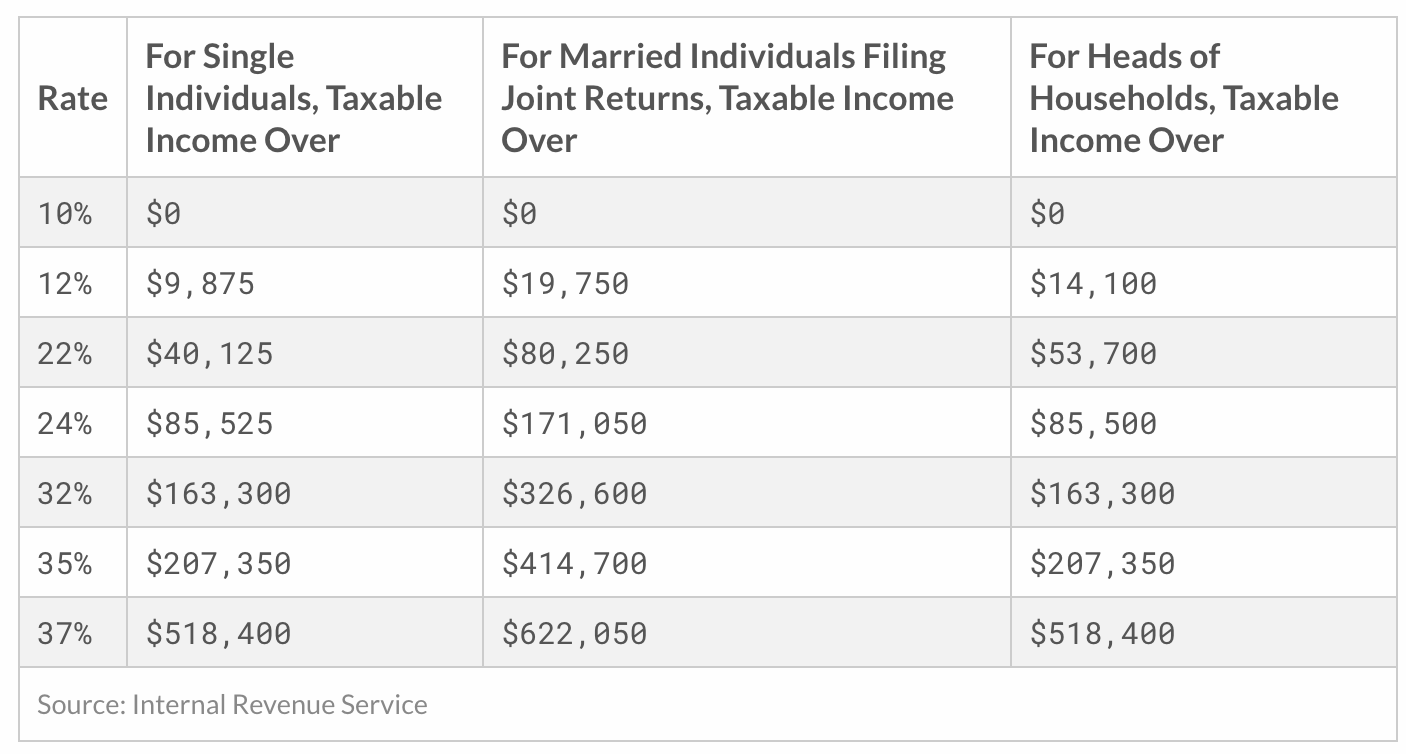

2024 Trucker Per Diem Rate & Tax Brackets Released Per Diem Plus, Click here to watch the full webinar. Per diem does not apply for lodging.

Source: www.perdiemplus.com

Source: www.perdiemplus.com

Trucker Per Diem Rules Simply Explained Per Diem Plus, If you’re a company driver, you will not have to submit receipts or request reimbursement for expenses covered by your per diem. He also previously served as the consulting per diem tax expert for omnitracs.

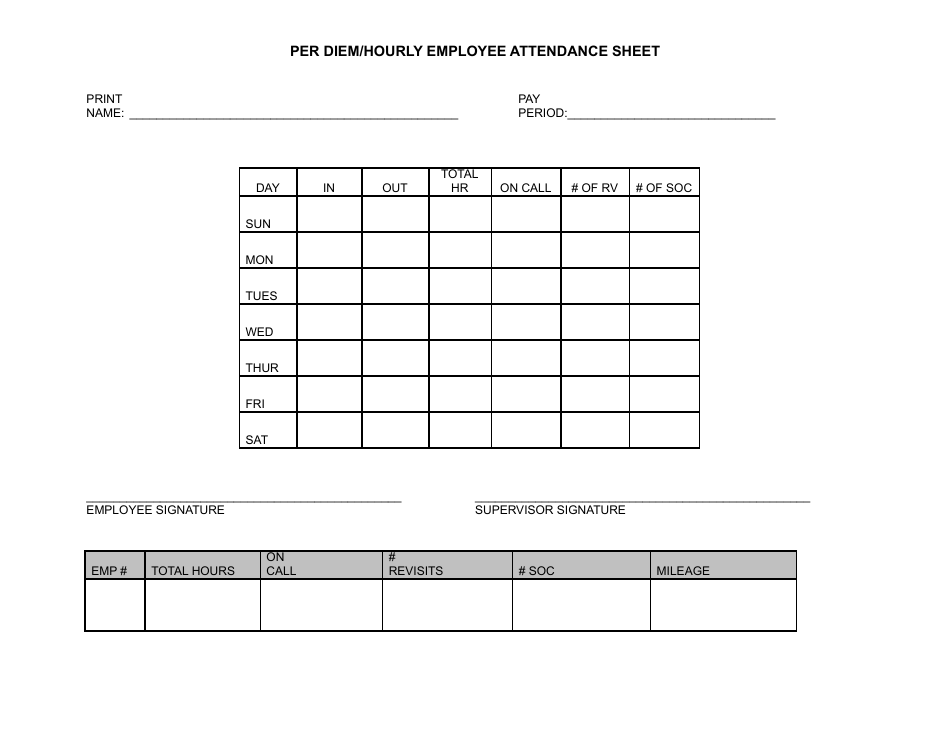

Source: templates.rjuuc.edu.np

Source: templates.rjuuc.edu.np

Per Diem Template, Seizing the per diem tax break (for truck drivers) | atbs. You can access all other foreign per diem rates at aoprals.state.gov/web920/per_diem.asp.

Source: www.perdiemplus.com

Source: www.perdiemplus.com

2020 Trucker Per Diem Rates & Tax Brackets Per Diem Plus, Product download, installation and activation requires an intuit account and internet connection. Have a question about per diem and your taxes?

Per Diem Does Not Apply For Lodging.

If you’re a company driver, you will not have to submit receipts or request reimbursement for expenses covered by your per diem.

Special Rate For Transportation Workers.

Product download, installation and activation requires an intuit account and internet connection.